We are unique among

investment research firms

The Research Product

- 6-10 new ideas a year

- Typically 12-15 active ideas at any given point in time

- 500+ reports published since inception

- Research is backed by proprietary surveys and channel checks

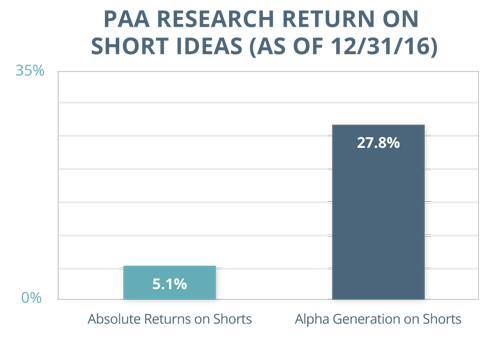

Alpha Generation of Our

Investment Ideas Is the True

Measure of our

Research Product

Our average short idea has generated 25%+ alpha.